There are three main modes to pay your online SECP Challan with the Securities Exchange Commission of Pakistan (SECP).

Here is an overview of the different SECP payment methods for you to decide the most convenient method for yourself.

How to pay SECP Challan

Credit Card

This is the most preferred payment method and can be done online using a credit or debit card. The only catch is the 3.7% bank charge. No need to go to any bank or print anything. To use this option, select “Credit Card” as the mode of payment when you complete your SECP process form. After submitting the process, you can pay the due amount through the Online payment page on your SECP interface.

SECP Manual Bank Challan Payment (MCB and UBL Only)

This method is for those who do not wish to pay by credit or debit card and would rather walk into a bank with a challan form / deposit slip / SECP invoice.

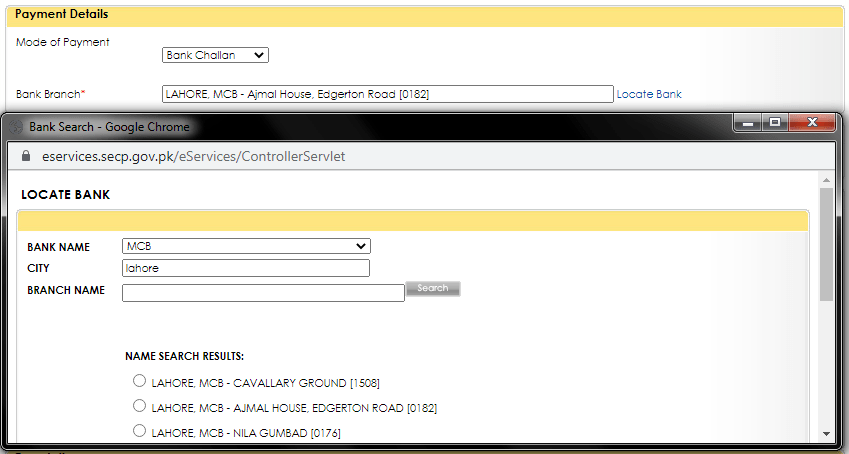

While completing the SECP process form, select “Bank Challan” as the mode of payment, and select which bank branch is the most convenient for you. Note that payments to SECP via this method are only available at MCB or UBL Bank Branches.

After submitting your process you will have some 10-14 days to make your payment. Download and print the challan form from the Process Document Listing Page and take it to the branch you selected during the method of payment selection. Keep a receipt of your payment or deposit slip after making the payment.

SECP EChallan ADC/epayment

ADC e-payment to SECP is available for MCB and UBL customers only. IF YOU DO NOT HAVE AN ACCOUNT WITH EITHER OF THESE BANKS, DO NOT SELECT THIS OPTION BECAUSE YOU WOULD HAVE TO CANCEL THE PROCESS AND DO EVERYTHING ALL OVER AGAIN.

If you do however have an account with MCB or UBL, you can select this option and pay SECP through your mobile banking app by adding SECP as a bill/payee and entering the PSID number. You can also do the payment from your MCB or UBL account by going to a branch and giving them the PSID number. There may be a bs charge of 25 rupees.

The PSID number will be generated after you have submitted the process and can be viewed from the ADC/ePayment tab on the SECP portal.

How to open a corporate bank account

Learn how to obtain a Paid Up Capital Certificate